Mortgage calculator additional borrowing

Check out the webs best free mortgage calculator to save money on your home loan today. This is because youre borrowing over a much longer period of time with a mortgage.

Current Mortgage Apr Annual Interest Payments Per Thousand Dollars Borrowed Calculator

Redraw- Access your additional payments if you need them.

. Some additional factors include your desired down payment as well as your other regular monthly expenses. The type of mortgage you choose will determine the type of interest you can expect to pay whether this is a Fixed-rate or Variable. This is the best option if you are in a rush andor only plan on using the calculator today.

Estimated monthly payment and APR calculation are. Mortgages are how most people are able to own homes in the US. The Loan term is the period of time during which a loan must be repaid.

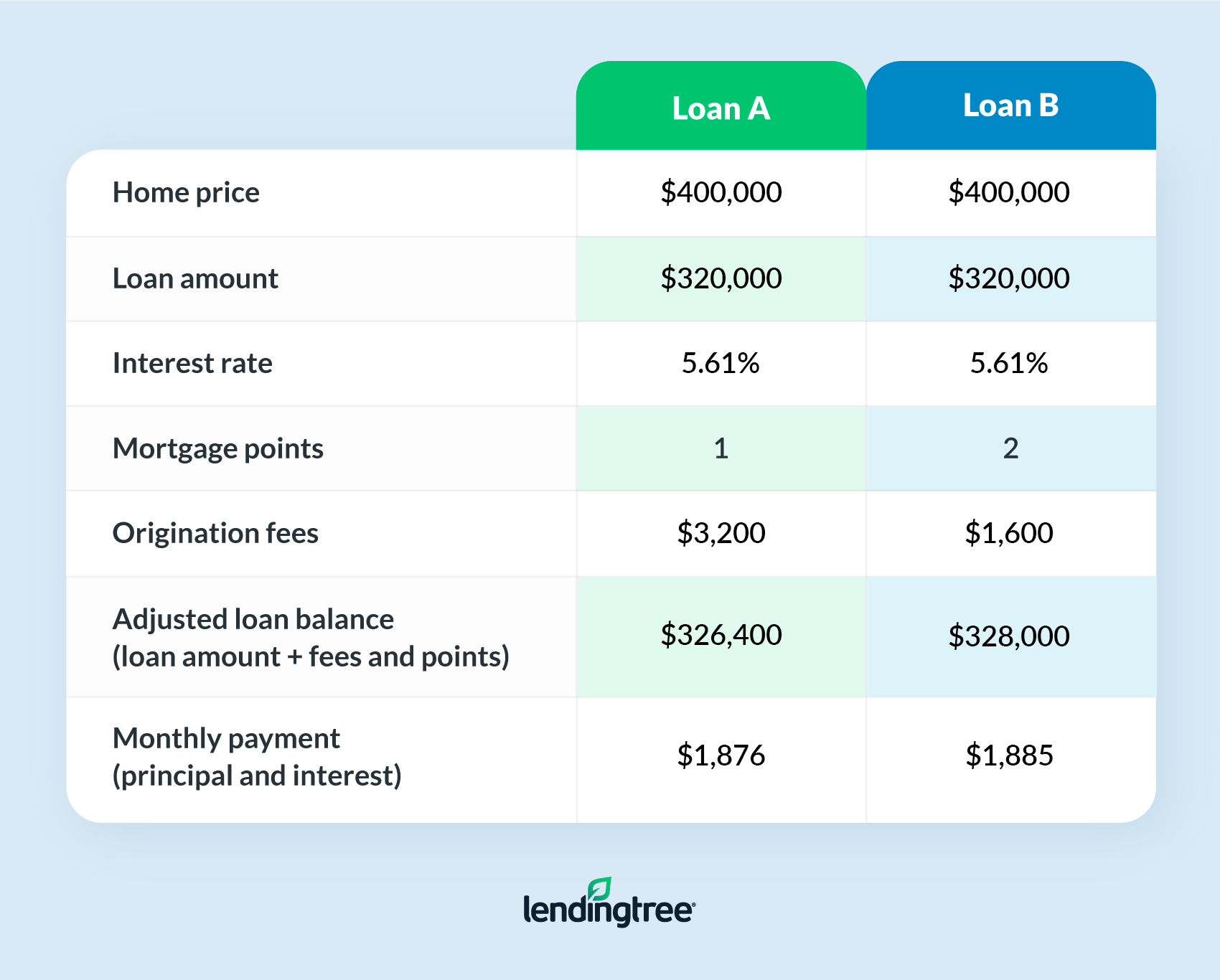

Calculate the additional repayment amount required to pay off your loan faster. A mortgage calculator helps to. Or view two different loan amounts that carry the same interest rate and repayment period.

Borrow more on your Royal Bank of Scotland residential mortgage to help realise your plans for those home improvements dream holiday etc. Calculate the cost of mortgage repayments. Mortgage principal is the amount of money you borrow from a lender.

Essentially the higher the interest rate the higher your monthly mortgage payments are likely to be. These are also the basic components of a mortgage. You pay the principal with interest back to the lender over time through mortgage payments--.

It can also display one additional line based on any value you wish to enter. For an exact quote please contact one of our mortgage brokers by calling 1300 889 743. The federal government created several programs.

By entering the length of the mortgage your salary plus additional salary if youre looking to co-purchase your expenses and the number of any dependants you may have the calculator will assess your borrowing power based on. Comparing loan features side by side helps you find the mortgage loan you need. Its also helpful to consider property taxes and additional fees when.

This is the dollar amount of the mortgage you are borrowing. Often people do this to get better borrowing terms like. This is the best option if you plan on using the calculator many times over the.

Our LMI calculator asks for more information than other calculators you may find online. In the US the most common mortgage loan is the conventional 30-year fixed-interest loan which represents 70 to 90 of all mortgages. Estimate your monthly payments with PMI taxes homeowners insurance HOA fees current loan rates more.

With a capital and interest option you pay off the loan as well as the interest on it. Our calculator includes amoritization tables bi-weekly savings. Our borrowing power calculator gives you an initial estimate of what a lender may be willing to lend to you.

The home equity line of credit calculator automatically displays lines corresponding to ratios of 80 90 and 100. A 225000 loan amount with a 30-yea r term at an interest rate of 3375 with a down-payment of 20 would result in an estimated principal and interest monthly payment of 99472 over the full term of the loan with an Annual Percentage Rate APR of 3444. Mortgage Calculator zip file - download the zip file extract it and install it on your computer.

Compare two fixed rate loans with different rates repayment periods. The mortgage should be fully paid off by the end of the full mortgage term. Mortgage Calculator exe file - click the link and immediately run the mortgage calculator.

Use the app to get loan insights to help you pay off your home loan faster. Segments of the market can change faster than the overall market due to those same sorts of factors along with various legal changes tied to. The mortgage industry of the United States is a major financial sector.

Mortgage interest rates are the additional cost associated with borrowing from a lender to buy a property. At the end of the mortgage term the original loan will still need to be paid back. Borrow more on your mortgage with additional borrowing and pay for home improvements a special purchase like a car debt consolidation or another property.

Weve used our loan calculator to highlight some examples below. Your Mortgages borrowing power calculator considers a few important factors that can determine your borrowing capacity or how much you would be eligible to take out on a home loan. For example if your lender will allow a 95 ratio the calculator can draw that line for you in addition to the other three.

Identify how much you may be able to borrow for a mortgage. With several primary inputs as well as additional advanced fields that account for PMI homeowners insurance zip codeproperty taxes and homeowner association fees Guaranteed Rates home mortgage calculator incorporates almost every conceivable variable that could affect your mortgage costsThe result is an estimate of future monthly. Conforming Fixed-Rate estimated monthly payment and APR example.

The amount of additional money you want to take out. In this way it can give a more accurate result by. Mortgage calculator Calculate your monthly mortgage payment.

Mortgage calculator - calculate payments see amortization and compare loans. If you are a Scotiabank mortgage customer depending on the mortgage solution that you select each year you can increase your scheduled monthly payments by up to 10 15 or 20 of the payment initially set for your term or in some cases your current payment and make a lump sum prepayment of up to 10 15 or 20 of your original principal. The typical scenario is that terms of the loan are beyond the means of the ill-informed and uneducated borrower.

Overall mortgage debt tends to grow around 3 to 6 per annum though there can be significant fluctuations in that rate of growth due to factors like BREXIT the global economic crisis which happened in 2008 COVID-19 lockdowns etc. Use our free mortgage affordability calculator to estimate how much house you can afford based on your monthly income expenses and specified mortgage rate. A mortgage calculator can help borrowers estimate their monthly mortgage payments based on the purchase price down payment interest rate and other monthly homeowner expenses.

A mortgage calculator can be a handy tool to help navigate finances prior to kickstarting your home-buying journey. This mortgage comparison calculator compares loans with different mortgage rates loan amounts or terms. A mortgage calculator is a smart first step to buying a home because it breaks down a home loan into monthly house payments based on a propertys price current interest rates and other factors.

Confirming which lendersmortgage insurers are likely to accept your mortgage application. With an interest only mortgage you are not actually paying off any of the loan. An Adjustable-rate mortgage ARM is a mortgage in which your interest rate and monthly payments may change periodically during the life of the loan based.

You could potentially in some circumstances borrow up to a maximum of 90 of the value of your home. A mortgage usually includes the following key components. Are finding loopholes in the law to obtain additional profit.

The borrower makes a number of interest and. If a mortgage is for 250000 then the mortgage principal is 250000. For example a 30-year fixed-rate loan has a term of 30 years.

A Fixed-rate mortgage is a home loan with a fixed interest rate for the entire term of the loan. Also offers loan performance graphs biweekly savings comparisons and easy to print amortization schedules. The calculator allows you to enter a monthly annual bi-weekly or one-time amount for additional principal prepaymentTo do so click Prepayment options.

Ltv Calculator For Mortgage Pmi Refinancing Mortgages Home Equity Loan Qualification

New House Moving Announcement Zazzle Com Moving House Moving Announcements New Homes

Downloadable Free Mortgage Calculator Tool

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Lvr Borrowing Capacity Calculator Interest Co Nz

Download Microsoft Excel Simple Loan Calculator Spreadsheet Xlsx Excel Basic Loan Amortization Schedule Template

Simple Loan Application Form Template Beautiful Personal Loans Calculator India Quick And Easy Cash Contract Template Letter Templates Personal Loans

Borrowing Power Calculator Sente Mortgage

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortization Schedule Template With Extra Payments

Apr Vs Interest Rate What S The Difference Lendingtree

What Is A Home Equity Line Of Credit Or Heloc Nerdwallet

What You Need To Know About 401 K Loans Before You Take One

Borrowing Base What It Is How To Calculate It

/MortgateRates.Fed.StL-0099d59e398e4f239bc0cc4154e04cb7.jpg)

Mortgage Calculator

Hard To Borrow Fee Calculation Ally

Downloadable Free Mortgage Calculator Tool

Hard To Borrow Fee Calculation Ally